Streaming wars

“Streaming wars” focus obscures existential change in entertainment

The narrative in TV for the last five years has been when, not if, online surmounts traditional but Hub Entertainment Research’s latest Video Redefined study has indicated how much TV in all its forms is now more in competition with gaming, and social media.

The new Video Redefined study was conducted among 1,900 US consumers age 13-74 in December 2022 and the standout finding centred around Gen Z viewers, showing how this cohort now have an entirely different definition of “entertainment”. Specifically, for decades, TV has been the focus of the entertainment ecosystem but for Gen Z consumers, it’s just one of several ways they spend their time.

The study found that Viewers aged over 35 said they spend more time watching TV than any other kind of screen-based entertainment, 43% of their total screen time. Only about a fifth of their time goes to gaming or non-premium online video on platforms like YouTube or TikTok. Among those age 13-24 this proportion is inverted: less than a fifth of their screen time (17%) is spent on TV shows. They spend more than twice that on gaming and non-premium video combined.

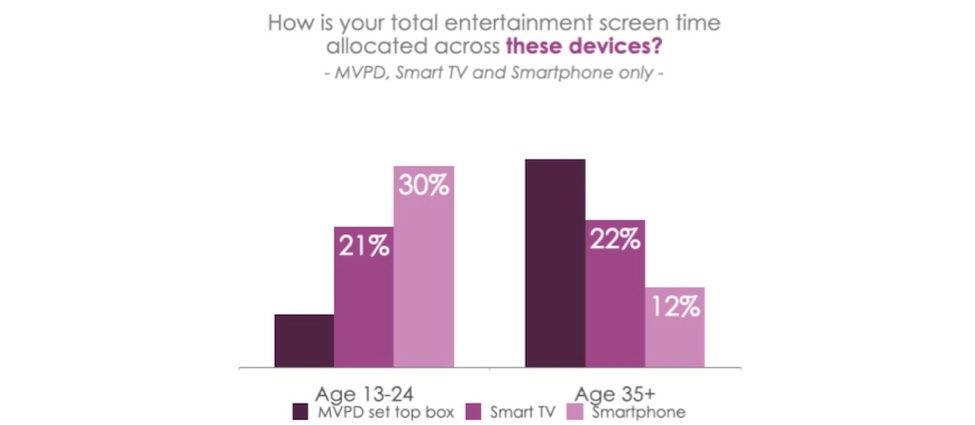

The disparity in content between the youngest consumers and their older counterparts was also mirrored in the screens they use. Both groups allocate about a fifth of their total screen time to content on a smart TV. But otherwise, device usage of the two groups was shown to be very different. That is, viewers age 35+ estimated they spend about a third of their total screen time watching content through a pay-TV set top box and only 12% to entertainment on a phone. Those aged 13-24 allocate the most time (30%) to content on their smartphone, and only 8% to content through a cable box.

The study also confirmed the rise and rise of TikTok, which it said has quickly become an entertainment hub for young consumers. YouTube remained the biggest player in “non-premium” online video: more than 80% of respondents use it regularly. Among those age 13-24, two-thirds of the survey when questioned said that they had used TikTok in the past week, second only to YouTube.

Among those using TikTok, 72% said they watched it every day, compared with just 48% of YouTube users in that age group. Among those who used both, more than half (51%) say they’d choose TikTok over YouTube if they could only have one.

“The ‘streaming wars’ monopolise the spotlight when it comes to predicting the fortunes of media companies in the future,” said Jon Giegengack, principal at Hub. “But this obscures an even more important shift: the next generation of TV consumers are just less engaged with traditional TV itself. Gaming and social video are the focus of their entertainment lifestyles. There’s no reason to assume they’ll grow out of these habits as they age. Media organisations need to adapt to these changes in order to meet tomorrow’s viewers on the devices and platforms where they will spend most of their time.”