US-ownership of European channels increases

A report from the European Audiovisual Observatory has revealed the considerable presence of US players in the European TV and on-demand sector with American owners making particular traction in the children’s TV sector.

Euro obs childrens tv 4July2023Agnes title page

The Audiovisual Media Services in Europe 2023 study found that by the end of December 2022, the European audio-visual sector boasts a total of 12,664 media services available in the wider European region. Around three quarters of these are linear services 9,349 TV channels and a quarter are non-linear services, including 3,315 VOD services and video-sharing platforms.

With regards to ownership, the European TV market is divided into a public sector with mainly generalist programming available on DTT networks and a private sector which has expanded into thematic cable, IPTV, and satellite channels. Almost all on-demand services are privately owned (97%). Public service media have entered the market as well, mostly offering catch-up of their linear programming. One in five public on-demand services are paying services, for example the international version of the BBC iPlayer.

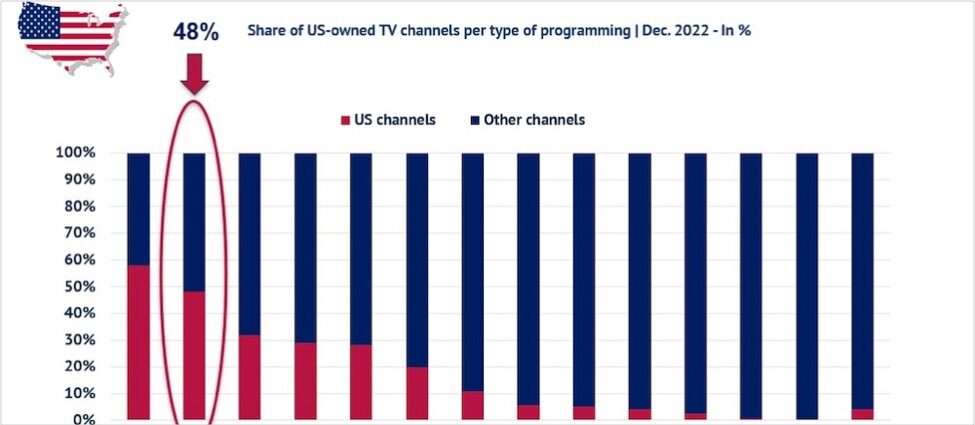

Non-European players have taken a strong foothold in the European AV market. One in five of the top 50 TV groups and more than a third of the top 50 groups for on-demand services has a non-European parent company. The majority of non-European parent companies of AV services in Europe were US players. Around one in five (18%) of all TV channels (excluding local TV) are US-owned and over a third of all subscription VOD (39%) and transactional VOD (33%) services in Europe belong to a US company. US players dominated kids TV and entertainment SVOD. Around half of all children’s TV channels in Europe are US-owned (48%) and the same goes for 59% of entertainment subscription video-on-demand services.

Paramount’s Nickelodeon brand, the Disney Channel, AT&T’s Cartoon Network and AMC Networks JimJam are prominent examples. US players also dominate adult online entertainment with a 59% supply share of entertainment subscription video-on-demand services. US players also had the largest scope of operating markets across Europe. The Walt Disney Company, for example, has a virtual European omnipresence, operating in 44 European TV markets.

The report also revealed that within the actual content of AV services in Europe reveals significant differences between linear and non-linear services. While TV programming is largely defined by thematic fragmentation, on-demand services have a clear focus on film and TV fiction content.