Slump

Slump predicted for US video service spend

Research from Ampere Analysis is warning that 2023 will become known as the year when per-household spending on subscription streaming (SVOD) services in the US could no longer compensate for the continued decline in pay-TV and spend on video begins to shrink.

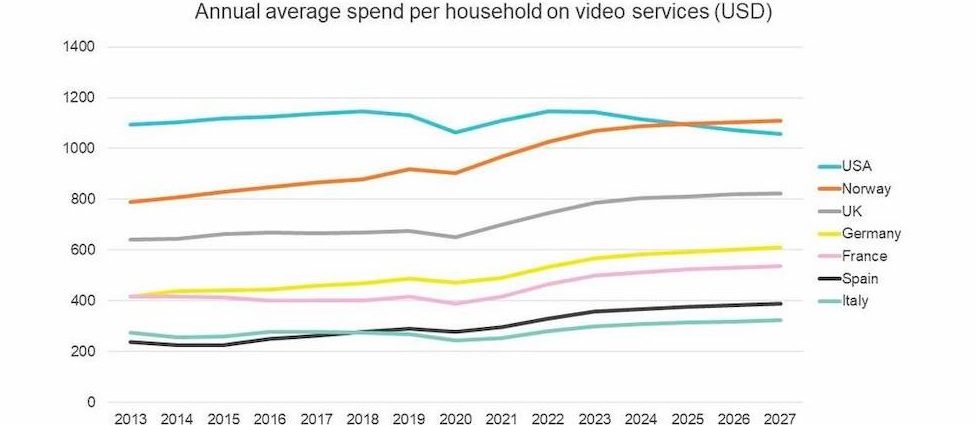

The study calculates that annual bills for video content peaked at $1,146 per household in the US in 2022 with a post-pandemic bounce-back in theatrical expenditure and an 18% year-on-year increase in SVOD outlay to $374 per household per year. However, Ampere says 2023 will see US SVOD revenue growth slowing, hindered by market maturity and economic pressures, and with the added impact of cord-cutting seeing yearly pay-TV investment per average household fall below $650 for the first time since 2006.

The result is likely to be the beginning of a slow decline in annual average household expenditure on TV and by 2027, US households are set to invest $90 less annually on video services making the average annual spend per US household on video services fall by 8%.

“Spend on video has finally hit its limit for US households. As the US subscription OTT market edges closer to saturation point and demand for pay TV continues to fall, annual spend per household on video services has tipped into decline,” said Ampere Analysis senior analyst Maria Dunleavey. “By 2027, unless streaming services can sustain significant price inflation, US households will be investing almost 90 dollars less per year on video services. Recent moves from TV groups to focus on hybrid tiers and free ad-supported video services represent one approach to compensating for this downward pressure.”

By contrast, Ampere noted that in Western Europe, pay-TV expenditure is more stable and the expansion of SVOD continues to drive spend on video, forecasting an 11% increase by 2027. The analyst calculated that Norway’s per household spend on video is set to overtake the US in 2025, the first Western market to do so. Norwegian homeowners will each be spending over $50 more on video than US households by 2027, and almost $300 more than the average UK home and substantially more than those in Germany, France, Spain and Italy.