More than one-third of US SVOD ready to reduce service spend

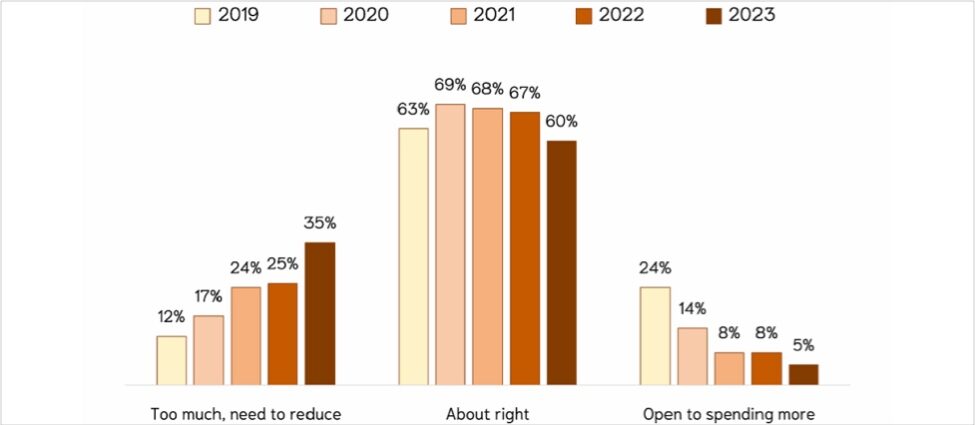

New and somewhat worrying research from Aluma Insights has found that as many as 35% of US subscription video-on-demand (SVOD) customers believe they are spending too much on services and are looking to cut back, representing a 40% increase over 2022 and threefold that of 2019.

Aluma SVOD Spending Preceptions 19July2023

The key finding of the study was that consumers are increasingly frustrated by ever-greater monthly streaming expenses and it is only going to get worse. Only 5% are interested in spending more on SVOD services, down 38% from 2022.

Aluma noted that with most SVOD providers still bleeding cash, growing subscriptions has taken a backseat to optimising revenue via higher prices, layoffs, and decreased content spending, among other measures. It added that when combined with the ongoing strike of writers and actors, it was all but certain the quality of content will decline even as prices increase.

On a positive note, the study revealed that inter-network SVOD bundles that combine services from competitive operators and offer subscribers a discount to standalone pricing, are finally attracting the interest they deserve. That said, Aluma observed that intra-network bundles like Disney’s package of Disney+, Hulu, and ESPN+ have largely run their course will take a back seat to ‘super bundles’ that more closely resemble pay-TV services. these were defined as now MVPDs per se, but app bundles that borrow several key elements of that model.

And while there remained ‘green field’ opportunities for SVOD providers, the report calculated that broadband was available to more than 90% of US households, leaving only 10% or roughly 14 million households to be served. Moreover, while federal subsidies for build-outs into unserved areas may help bring many of them online, Aluma argued that it would be years before deployments are complete and that there was no guarantee those unserved by broadband will be heavy buyers of streaming video services.

“That only one-in-twenty SVOD buyers are open to adding a new subscription service is the latest indicator that US demand for such services is largely exhausted. This does not mean mature SVOD providers will not add subscribers, only that such additions will be fewer, require more aggressive discounts, and be zero-sum purchases—that is, for every new service added, another must be cancelled,” said Michael Greeson, Aluma founder and principal analyst.

“Content owners that have long competed head to head with one another will engage in strategic bundling with competitors. This is not some kumbaya moment for the streaming industry, but a strategic necessity for SVOD operators, much as joining cable TV bundles was for large over-the-air broadcasters more than 50 years ago. It’s about survival in a hyper-competitive marketplace.”