Almost half of online users switch off broadcast TV

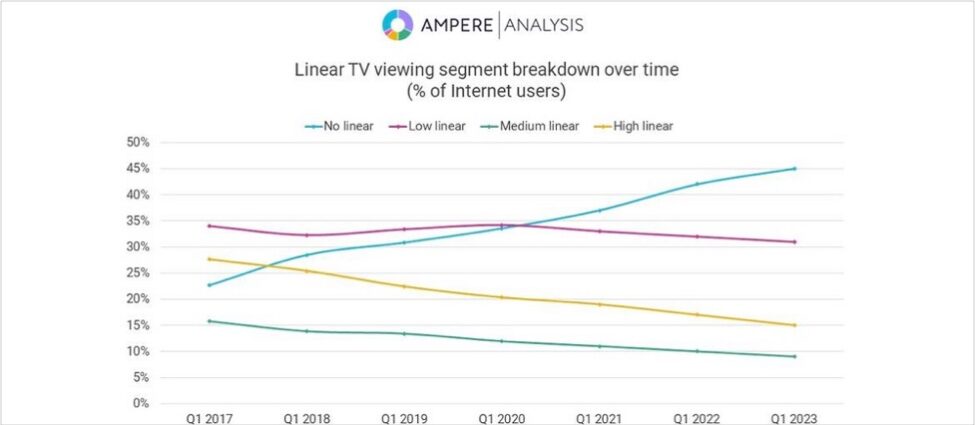

In just two years, the proportion of Internet users claiming to watch little to no linear TV in a typical day grew 22% to almost half (45%) according to a study from Ampere Analysis, with over half of saying they watch more than four hours of streaming TV in a typical day.

The study was based on proprietary consumer research carried out with 54,000 adults aged 18-64 across 28 markets worldwide and among the stand out findings was that younger groups were most disengaged with broadcast TV, 35% of those claiming to watch no linear TV were over 45 years old. This represented a rise from the 28% posted in the first quarter of 2017.

According to Ampere, in Q1 2021, 37% of Internet users claimed to watch little to no linear TV on a typical day. In Q1 2023, this figure was up to 45%, an annual increase of 22%. By contrast, the number of high linear TV viewers – those who watch at least four hours of broadcast TV daily –also declined in the same two-year time frame, down from 19% of respondents in Q1 2021 to 15% in Q1 2023. In, addition, the number of Internet users saying they watch more than four hours of video- on-demand (VOD) content in a typical day was up from 58% in Q1 2021 to 62% in Q1 2023.

Additionally, while consumers are turning away from linear broadcast TV, broadcasters’ investment in their own VOD services has ensured they can still engage those audiences who prefer to watch via streaming. Engagement with these broadcast-led video services has increased by 26% since Q1 2023.

Yet the analyst stressed that it was far too early to write off linear TV. It noted that the stability of low-level viewing, defined as less than two hours per day, suggested that many Internet users still tune in for key live events such as sports, major reality TV show and exclusive dramas. Ampere sees these content pillars as remaining a key part of acquisition and commissioning strategies for linear broadcasters. In addition, it said that despite broadcasters’ traditional audiences moving away, there are opportunities to retain viewers through a mix of live and event content, and via enhancing broadcaster streaming offerings.

“At first glance, the decline in linear TV viewing looks to be a worrying trend for broadcasters as their traditional audience begins to drift away,” remarked Minal Modha, research director at Ampere Analysis. “However, as the increased engagement with broadcast-led video services shows, if the linear channels can continue to adapt and provide a strong OTT offering for audiences switching from scheduled TV channels, they have an opportunity to retain them, albeit on a different medium.”