US video stack shrinks

As consumers express significant concerns about the state of the economy and rising inflation, some of them have turned to their video subscriptions as a means of saving money says a study from Hub Entertainment Research.

HUb stacking 15JUne2023

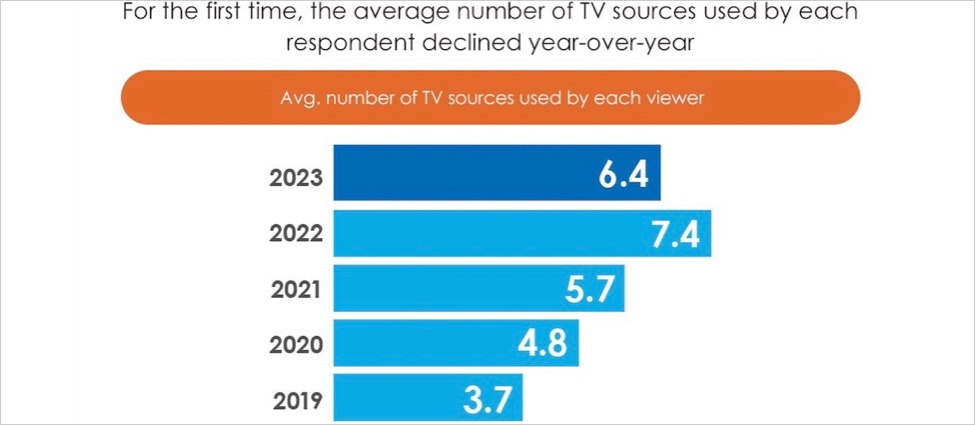

Hub’s annual Best Bundle survey revealed that in 2023, for the first time, there was a year-on-year decline in the number of video sources viewers say they are using, something that the analyst said was of no surprise. It added that for video providers who benefited from consumers stacking more and more video subscriptions, a very good thing has ended – at least for now.

The survey revealed that while MVPD cord-cutting was continuing unabated over the past few years, media companies could still rely on SVOD growth to offset some of the decline in linear TV viewership. However, Hub emphasised that in 2023, the cord-cutting trend persisted and was soon accompanied by a decline in SVOD subscriptions.

The study observed that the Big 5 SVOD providers – Netflix, Amazon Prime, Hulu, Disney+ and HBO Max – in particular experienced a decline in subscribers since last year. Not only did overall usage of any of the five platforms decrease compared to 2022, but fewer households opted to stack three or more of them. Hub added that although it may be tempting for media companies to anticipate consumers reverting to adding subscriptions to their stacks as inflation moderates, such optimism may be misplaced. Viewers consistently prioritize value ahead of pure price when deciding which SVODs to keep.

That said, Hub also indicated that one bright spot in the video ecosystem continues to be FASTs. After steep increases in consumption in 2021 and 2022, usage of these free video alternatives remained strong in 2023. As more households cut the cord, FASTs provide viewers with an alternative to lean back and surf through an array of linear streaming channels.

“If the ongoing writers’ strike persists long enough to significantly disrupt content pipelines, the value proposition of most services won’t be attractive enough to entice subscribers to return any time soon,” commented Hub senior consultant Mark Loughney. “It could be two years or longer to determine whether the decline in the first quarter was a momentary pause in the growth of the SVOD ecosystem or a permanent reset.”