SVOD keeps pace in East Asia

Despite a global slowdown, and with homes in the established markets experiencing fatigue and major players starting to lose subscribers, the subscription video-on-demand (SVOD) market is still going strong in East Asia says research from Dataxis.

The study points to an interest in premium content, with East Asian markets showing differentiated consumption habits high purchasing power, multiscreen content consumption and high connectivity rates that enable large-scale streaming.

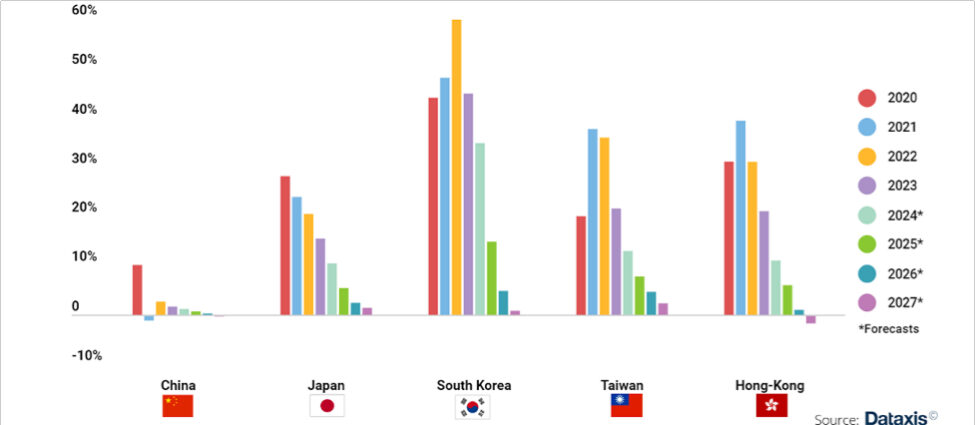

In Japan, the SVOD subscriber base was found to be growing strongly and is estimated to do so until 2027. ARPU is projected to start decreasing in 2025, thus enabling revenue growth until 2025. Growth is even more dynamic in South Korea, where both the 15 million and the 20 million subscribers’ milestones were passed in 2022. Quite surprisingly, said Dataxis, ARPUs have already started stabilising, and have even slightly decreased for some players even if this normally translates to the market having reached maturity.

The Hong-Kong and Taiwanese SVOD markets combine these two phenomena. On the one hand, their subscriber bases have grown 31% and 35% year-on-year respectively in 2022. They currently amount to 3 million accounts in Hong-Kong and 5 million in Taiwan. ARPUs in these markets have been stable around 30 HKD ($3.85) and 161 TWD ($5.77) respectively since 2020. Dataxis expects them to start decreasing as of 2023.

In contrast, China is the only country experiencing SVOD fatigue in the region and the report speculates that the country may have reached its glass ceiling. Most platforms lost subscribers at Q4 2022, and the overall subscription number has stabilised around 375 million since Q1 2022. Among other effects, Dataxis believes that the tremendous success of AVOD can partially explain the current situation of the Chinese SVOD market.

Looking at companies in the market, Dataxis noted in its research that Disney+ has been the leading new entrant in over the last few years and now counts almost 3 million subscribers in the region after launched in Q2 2020 in Japan. Dataxis forecasts this number to triple by the end of 2027, thus accounting for a 13% market share. Only Amazon Prime Video and Netflix will enjoy higher market shares than Disney+ by then.