Western European pay-TV now primarily OTT

Highlighting the continuous progression of over-the-top (OTT) services and its adoption by telcos, at the end of the third quarter 2022, OTT pay-TV and IPTV offers had crossed the 50% penetration mark of pay-TV subscriptions in Western Europe says Dataxis research.

Furthermore, the study found that direct-to-consumer OTT now accounts for close to 60% of paying video in Western Europe as traditional premium satellite providers intensify their shift towards OTT.

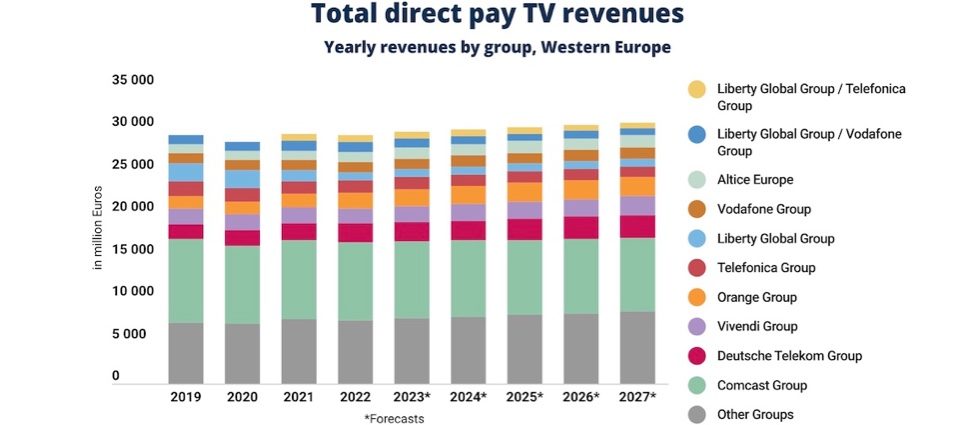

Dataxis noted that overall, historical pay-TV operators are increasingly turning away from traditional pay-TV offers to IP-based TV distribution. It calculates that in two years, the number of subscriptions to either IPTV or OTT has grown by almost 18% in Western Europe, while the other accesses have declined by 7.5%. The analyst expects this trend to accelerate in the future: the number of IPTV/OTT pay-TV subscriptions should increase by 22% between 2022 and 2027, and the subscriptions to legacy access should decrease by 13%.

The study highlights the trend whereby the success of SVOD and AVOD services, operators are trying to adapt to new trends and develop more flexible, richer offers with user friendly and personalised interfaces through IPTV and OTT solutions. They aim at capturing a part of the revenues generated by direct-to-consumer OTT services, which says Dataxis already represent 59% of video revenues in Western Europe.

To date, Dataxis reports 346 active partnerships between telecom operators and SVOD platforms in Western Europe, which it says should continue to increase to reduce complexity for users and facilitate their access to the largest amount of content. These deals are expected to create the most prevalent content offers model, provided that market fragmentation continues to structure the European OTT market in the coming years.

Dataxis believes this can be achieved by launching for instance a proprietary platform and cites the Viaplay Group in the Nordics and its eponymous platform, TV everywhere services like Tele2 Play in Sweden, or by developing partnerships with different OTT platforms.