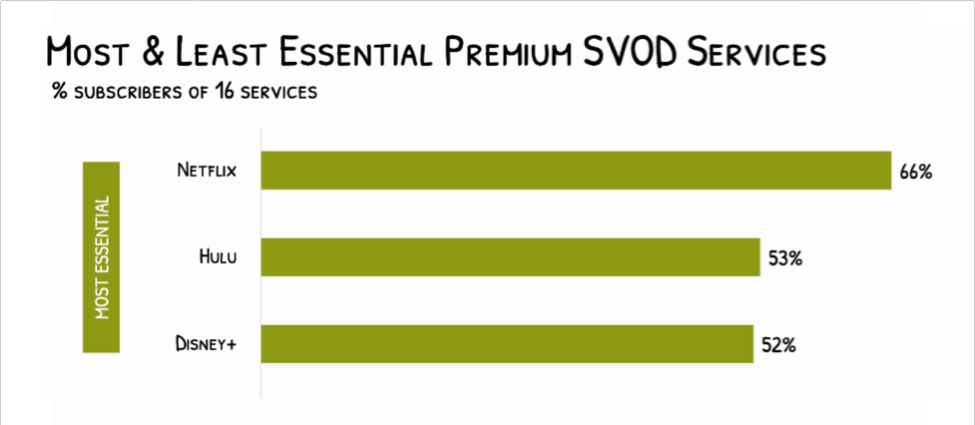

Netflix, Hulu, Disney+ head streaming users’ most essential services

Research from Aluma Insights has found that two-thirds of Netflix buyers view the service as fundamental to meeting household video needs, with only Hulu and Disney+ also having the majority of users considering the service essential instead of just nice to have.

The data comes from a December 2022 survey of 1,947 US adult broadband users in charge of purchasing media services for their household and that watch SVOD services on TV. Aluma balanced the sample to represent SVOD viewers and their households.

Noting that being indispensable has its advantages, Aluma added that the fact Netflix, Hulu, and Disney+ topped the essentials list was unsurprising and so was the finding that Epix Now was the least essential services. Yet it also thought finding Apple TV+ and Peacock among the bottom three services was unexpected. In its opinion, Apple TV+ was recognised for high-quality original content that resonates well with its subscribers. Yet Aluma also observed it had little depth in terms of third-party content and lower value than most other services, which may have reduced its stickiness.

Looking at he other services, Alima highlighted the fact that the 38% increase in ad-free Disney+ prices in December 2022 caused minimal subscriber losses, suggesting the service is not yet fully valued. Aluma expects standalone prices for both Disney+ and sister OTT service Hulu to increase by around 15% during 2023.

Though Peacock enjoyed a 28% increase in paid subscribers during 2022, only a third considered the service essential. Peacock owner Comcast is eliminating the service’s free ad-supported tier and is phasing out complimentary service for its Xfinity pay-TV subscribers. While the company has a great deal of confidence it can convert these users to paid subscribers, Aluma doubted this will be the case given how few current subscribers consider the service essential.

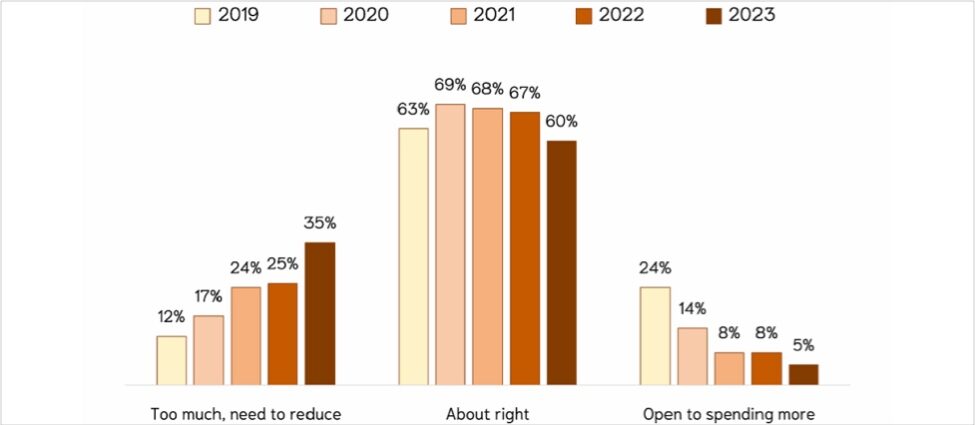

Going forward, the analyst said a greater risk to less-essential services would be plateauing monthly SVOD spending. Aluma found that in 2022 SVOD households spent on average $43.25 per month on the services, up significantly from 2020 but mostly stable compared with 2021. However, between 2020 and 2022, the percentage of SVOD buyers open to spending more declined from 14% to 8%, while the percentage who planning to reduce these expenses increased from 17% to 25%.

“As buyers move closer to their SVOD spending limits, less essential services will have a difficult time optimizing revenue without enduring sizeable subscriber losses,” said Aluma Insights founder Michael Greeson.