US players account

US players account for large swathe of Euro private TV, SVOD/TVOD

Research from the European Audiovisual Observatory has revealed that despite strong local TV industries, services from across the Atlantic continue to be taken up across all platforms.

The Audiovisual Media Services In Europe – 2022 Edition study looked at services in the EU27 countries, Albania, Armenia, Bosnia and Herzegovina, Georgia, Iceland, Liechtenstein, Montenegro, North Macedonia, the Republic of Moldova, Norway, Serbia, Switzerland, Türkiye, the UK and Ukraine.

The research fundamentally found that the European audio-visual (AV) media services sector has been shaped by the development of its unique national media ecosystems. It found that the market boasts a total of 12, 275 media services available in the wider continent. Around three-quarters of these are linear services, 9,080 TV channels, and a quarter were non-linear services, comprising 3,195 video-on-demand (VOD) services and video-sharing platforms.

Non-European players have taken a strong foothold in the European AV market. The research found that one in four of the top 50 TV groups and more than a third of the top 50 groups for on-demand services had a non-European parent company.

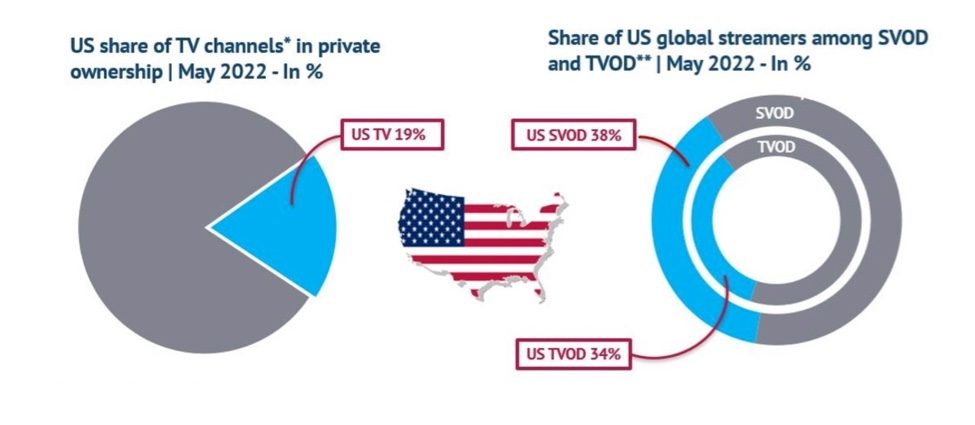

US players represent most non-European parent companies of AV services in Europe. Around one in five (19%) of all private TV channels (excluding local TV) were US-owned and over a third of all SVOD (38%) and TVOD (34%) services in Europe belonged to a US company. For multi-country SVOD and TVOD services, one catalogue is counted as one service.

Additionally, US players were all fully operating on pan-European level, serving numerous European markets. The Walt Disney Company, for example, has a virtual European omnipresence operating in 45 European TV markets.

With regards to establishment hubs, pan-European players were employing different strategies. Netflix deployed a centralised strategy with a single country of establishment from where it is targeting the European markets. A core hubs strategy is used by the BBC, where typically a small number of countries serve as a basis to target various national markets. AT&T, by contrast, applies a decentralised strategy where a larger number of establishment hubs serve the European markets.